This post may contain affiliate links and WPF may earn money or products from companies mentioned. Our guest post plugin stopped working! Please note that the authors listed may not be accurate here :( More info

Table of Contents

1. Empower – Dashboard, App & Tools, Free to Use!

Empower (formerly known as Personal Capital) is our top pick (and personal daily use favorite) for those who want a comprehensive financial overview without any costs attached. This app shines by delivering a full snapshot of your finances, helping you manage everything from budgeting to monitoring your investments plus retirement planning and projections. While Empower does offer asset management services, there’s no obligation to use them—you can bypass the pitches and still benefit from its top-tier tools. It’s perfect for users who want to stay on top of their financial health without diving into complex planning.

However, if you’re interested in moving beyond budgeting and want to explore detailed financial projections, ProjectionLab might be worth checking out. It offers advanced simulations and scenario testing for those looking to strategize their financial independence or retirement in more depth.

2. Monarch Money – 7 Day Free Trial

For the visual planner in you, Monarch Money offers a sleek, intuitive way to see your full financial picture in one place. It’s ideal for folks who want a modern, collaborative tool that blends budgeting, goal setting, and investment tracking without needing to assign every dollar a job. Use our WPF link to start your free 7-day trial and see how it transforms your money mindset.

While we’ve got a long history of love for YNAB in the WPF community (and it definitely still has a loyal fan base) we’ve been hearing more and more people fall for Monarch lately. The two serve different styles: YNAB is for the meticulous budgeter who thrives on structure and loves giving every dollar a mission. Monarch, on the other hand, appeals to folks who want a broader view, a little more automation, and an easier way to track shared finances or big-picture goals.

We know there’s no right way to manage your money, just the one that fits your brain, your life, and your values best.

3. ProjectionLab – 7 Day Free Trial

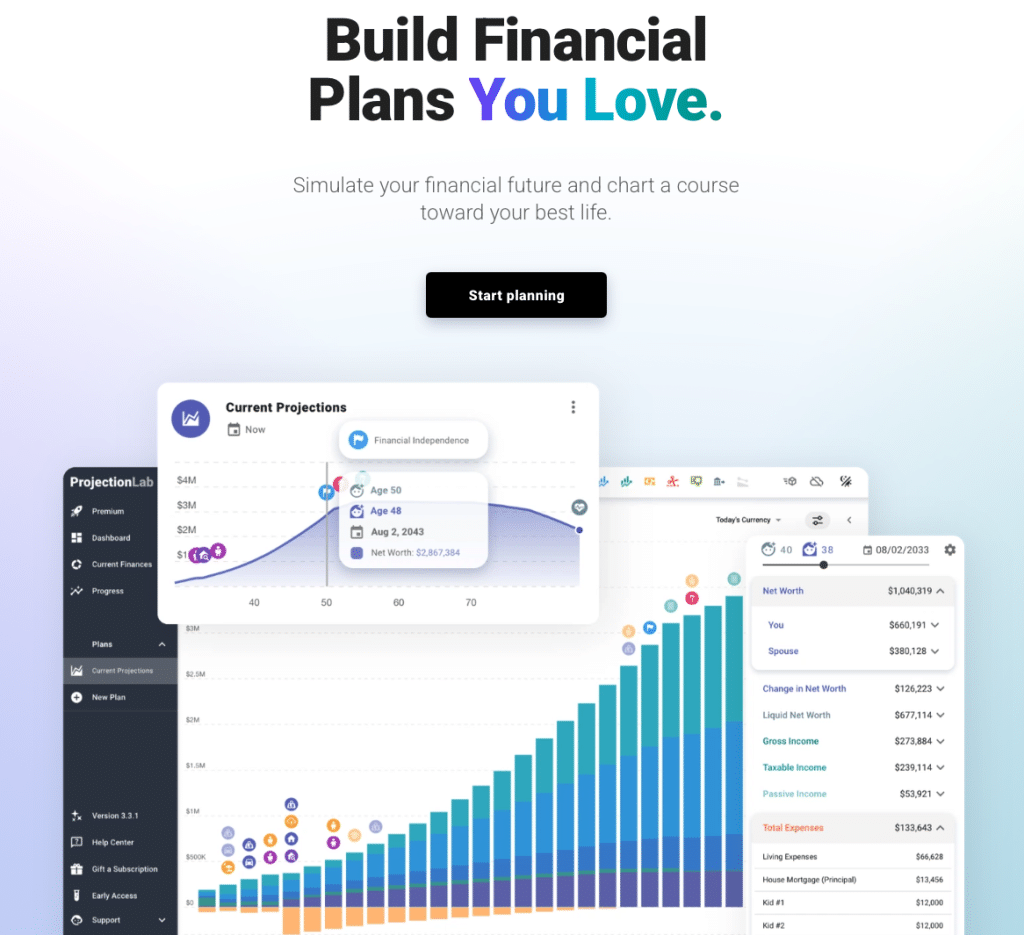

If you’re FIRE-curious or trying to wrap your head around what long-term financial independence could actually look like for your life, ProjectionLab is one of the most useful retirement planning tools out there. It’s designed to help you model real-world scenarios like CoastFI, early retirement, adjusting savings rates, or taking a lower-paying but more values-aligned job, without relying on overly simplistic assumptions.

ProjectionLab is especially popular in the WPF community with folks who are ready to move beyond monthly budgeting and into big-picture planning. It gives you a visual, flexible way to test different paths forward, stress-test your assumptions, and see how today’s choices affect your future over time. It’s powerful without being intimidating, which makes it a great option if spreadsheets aren’t your thing but you still want a robust financial independence calculator.

This isn’t about predicting the future perfectly. It’s about giving yourself clarity, optionality, and a sense of what’s realistically possible. Use ProjectionLab and start mapping out a path to CoastFI or financial independence that aligns with your values and real life.

4. You Need A Budget (YNAB) – 34 Day Free Trial

For the meticulous budgeter in you, YNAB offers a hands-on approach built around giving every dollar a job. It’s especially well suited for people who want to actively manage cash flow, break the paycheck-to-paycheck cycle, or build stronger day-to-day money awareness. If you like structure, clear rules, and checking in with your budget regularly, YNAB tends to click fast.

YNAB has a long-standing fan base in the WPF community because it teaches a way of thinking about money, not just tracking it. That said, it does require ongoing engagement. This is a tool for people who enjoy staying close to the numbers and don’t mind a little friction in exchange for clarity and control. Enjoy a 34-day free trial and see if this style of budgeting fits your brain and your life.

5. Tiller – 30 Day Free Trial

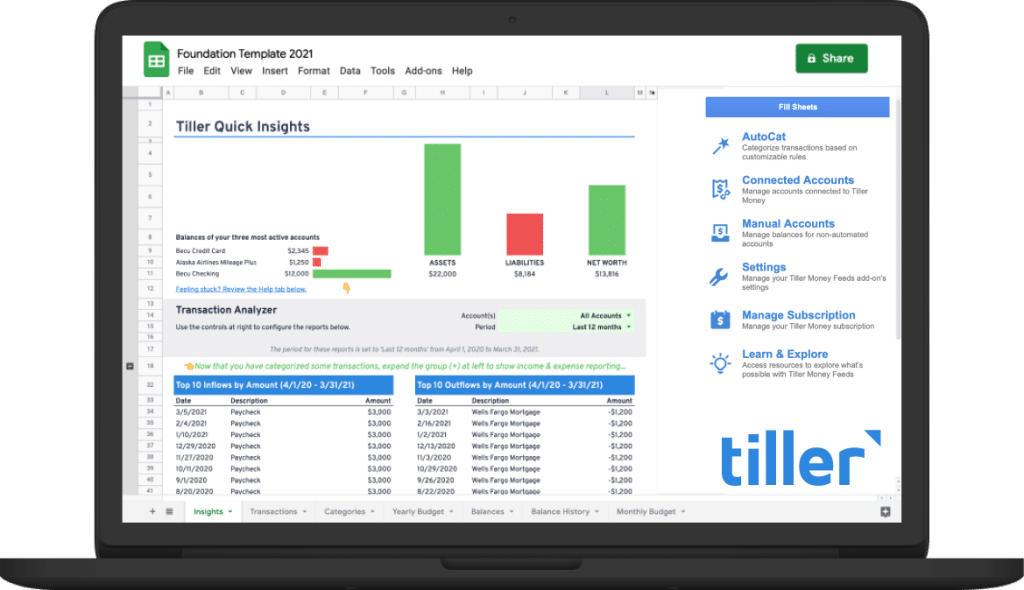

If spreadsheets are your love language, Tiller might be your dream tool. Instead of forcing you into a pre-built system, Tiller connects directly to your accounts and feeds your data into customizable Google Sheets or Excel templates. It’s ideal for people who want transparency, flexibility, and full ownership of how their money data is organized.

We hear about Tiller constantly in the WPF community, especially from folks who want more control than traditional apps allow or who’ve outgrown simpler budgeting tools. There’s a learning curve, but the payoff is a system that adapts to you, not the other way around. If you enjoy tinkering, building dashboards, or tailoring your own money workflows, Tiller can be incredibly powerful. Start your free trial and explore what’s possible when your budget lives in a spreadsheet you control.

Budgeting is Better with Support!

| Money apps are powerful, but they work best with context, shared experiences, and people to talk things through with. That’s what our WPF communities are built for. Woven is our Patreon-style community for people who want to support WPF’s work and be part of the ongoing conversation — sharing wins, asking questions, and learning together across all stages of the money journey. Some folks are just getting started, others are years in. The common thread is community. For those who want deeper dives into financial independence, retirement planning, and optimizing the big picture, WPF Insiders is our more advanced, hands-on space with focused discussions and expert sessions. Wherever you are with money, there’s room for you here. |